China EV Boom and AI Surge: Why Hong Kong Stocks Are Outpacing Mainland Markets

Key Points

- US tariffs are inflicting more damage on North American markets than on China.

- China's EV sector is rising with companies like BYD, NIO, and Xiaomi thriving.

- Optimistic projections for the Hang Seng Index could see it reach 30,000 as stimulus measures kick in.

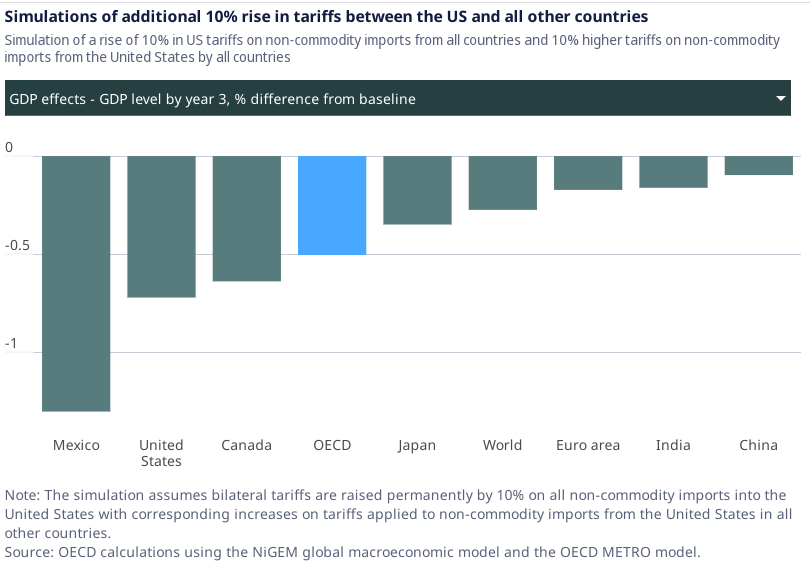

The OECD recently noted that US tariffs are hurting North America more severely than China. In fact, China’s economy is only experiencing minimal impacts, while US manufacturers are feeling the squeeze more acutely.

Economic Divergence

The Federal Reserve has projected a GDP growth decline in the US, markedly lower than the OECD’s forecast for China, which expects a 4.8% growth rate in 2025. This widening gap shows the stark contrast in economic recoveries between the two nations.

China’s EV Industry Takes Center Stage

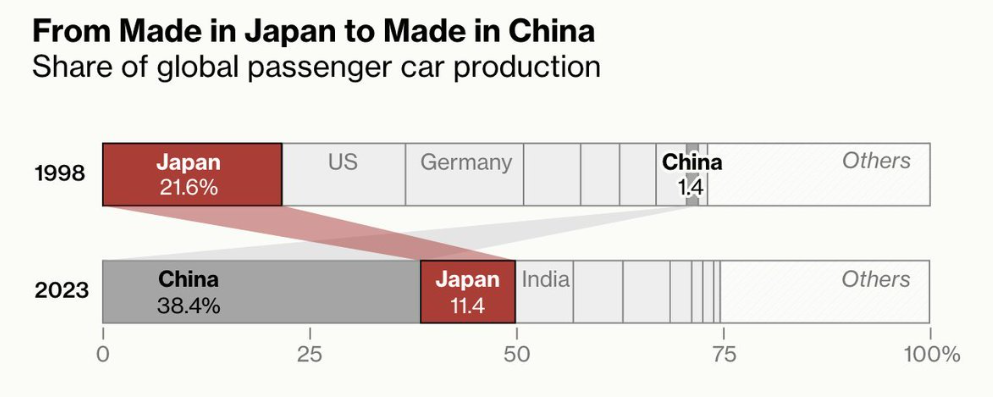

China's electric vehicle sector is gaining global recognition. Jostein Hauge from the University of Cambridge noted the rapid rise of China in global car production, jumping from 1.4% in 1998 to an astounding 38.4% today.

- BYD: Innovative charging and self-driving systems.

- NIO: Record monthly deliveries.

- Xiaomi: Expansion of EV production amidst high demand.

Meanwhile, significant declines were noted for companies like GM and Tesla in the US due to their reliance on the Chinese market.

AI Innovations Fueling Growth

China's success in artificial intelligence has redefined its tech landscape, with Tencent and others making strides that are markedly improving their stock performance. Investors are shifting focus towards Hong Kong as it outpaces mainland stocks significantly.

- Hang Seng Index: Surging 21.76% YTD, compared to slight increases in mainland indices.

Looking Ahead

With more stimulus measures on the horizon, the Hang Seng Index might see further gains. Stay updated on these market trends and how they could impact global investments.

Summary

This article highlights the robust advancements in China's EV and AI sectors and the consequent positive outlook for Hong Kong stocks, making it essential reading for anyone following global market trends.

Did you find this article useful? Let us know your thoughts!