China Retail Sales Surge, But Unemployment Rises – Market Reactions

Key Points

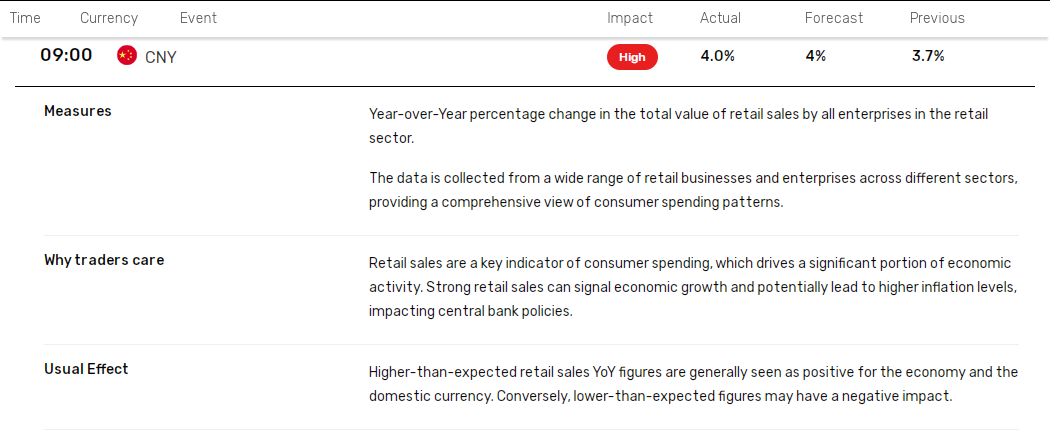

- Retail sales increased by 4% YoY; unemployment spikes to 5.4%.

- House prices have fallen by 4.8% in February, complicating economic revival.

- Beijing has unveiled a new action plan to stimulate domestic demand.

Summary

Despite the positive retail growth, China's economic landscape is fraught with challenges. Unemployment is rising and the housing market continues to show signs of distress, which together strain Beijing’s economic targets. China's strategic plan to boost domestic consumption through wage hikes and consumer incentives is a pivotal response to these issues.

Opinion & Analysis

The latest figures are a mixed bag for Beijing. The uptick in retail sales offers some hope that recent stimulus efforts are bearing fruit. Yet, rising unemployment could dampen consumer confidence, casting doubt on the sustainability of consumption-driven growth strategies. Beijing’s action plan could play a key role in stabilizing the economy if it addresses these critical areas effectively.

Furthermore, financial markets such as the Hang Seng Index and forex pairs like AUD/USD are displaying caution. The Hang Seng briefly spiked, yet overall sentiment remains wary as traders digest the implications of the recent data.

Market Reaction

In market movements, the Hang Seng Index rose by 0.84% and saw fluctuations as investors processed the data. Similarly, the AUD/USD pair experienced volatility before settling at a modest gain of 0.13%. Investor sentiments reflect cautious optimism but underline the importance of policy reinforcement in days to come.

Beijing's Response and Future Outlook

In response, Beijing is introducing measures like wage increases and expanded work programs, aiming to invigorate buying power among consumers. These efforts, along with subsidies for upgrading consumer goods, seek to revitalize economic activity amid global uncertainties.

The coming months are crucial as China navigates both internal and global economic challenges. Monitoring trade developments and policy changes will be essential for understanding future trajectories. Stay updated with our in-depth analysis to stay ahead of market trends!