Crude Inventories Rise by 1.7 Million Barrels; WTI Oil Tests Session Highs

By: Vladimir Zernov

Updated: Mar 19, 2025, 15:06 GMT+00:00

Key Points

- Strategic Petroleum Reserve increased from 395.6 million barrels to 395.9 million barrels.

- Domestic oil production remained mostly unchanged at 13.573 million bpd.

- Oil prices moved higher as traders reacted to the EIA report.

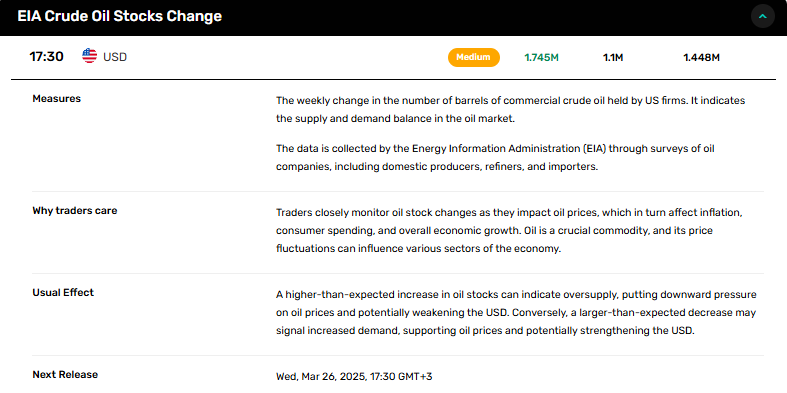

On March 19, 2025, the EIA released its Weekly Petroleum Status Report. The report unveiled that crude oil inventories rocketed up by 1.7 million barrels from the previous week, a figure that exceeded analyst forecasts, which were estimating an increase of just 1.1 million barrels.

With this increase, total motor gasoline inventories saw a decline of 0.5 million barrels, compared to an anticipated drop of 2.0 million barrels. Meanwhile, distillate fuel inventories decreased by 2.8 million barrels from the previous week, adding another layer to the evolving supply dynamics.

Additionally, U.S. crude oil imports dipped by 85,000 bpd, averaging 5.4 million bpd over recent weeks. In parallel, the Strategic Petroleum Reserve continued its gradual increase, suggesting proactive measures to bolster national oil reserves amidst a volatile global landscape.

Despite a slight dip from 13.575 million bpd to 13.573 million bpd in domestic production, levels remain elevated, which continues to present a bearish signal for the oil markets.

Market Reactions

As traders digested the implications of the EIA report, WTI oil settled near the $67.00 threshold. This uptrend indicates that while rising inventories may cast a shadow on immediate market outlooks, traders are likely to remain preoccupied with broader economic issues, including trade tensions, conflicts in the Middle East, and ongoing negotiations about a ceasefire in Ukraine.

Looking at Brent oil, the commodity persisted in its attempts to stabilize above the $70.50 mark post-release of the EIA metrics.

Summary

This week’s report shows crude inventories resoundingly rising, pushing oil prices to new highs even amidst other fluctuations in the market. As traders keep a lookout on geopolitical factors influencing supply and demand, today’s figures will surely play a crucial role in short-term price movements.

Opinion & Analysis

Overall, the weekly fluctuations in crude inventories highlight intricate ties between domestic oil production, strategic reserves, and global tensions. Staying informed and ready to react is crucial for traders in these volatile times. With significant external factors looming, careful attention to these weekly reports can be fundamental in crafting trading strategies.