NAHB Housing Market Index Falls to 39; SP500 Seeks Recovery

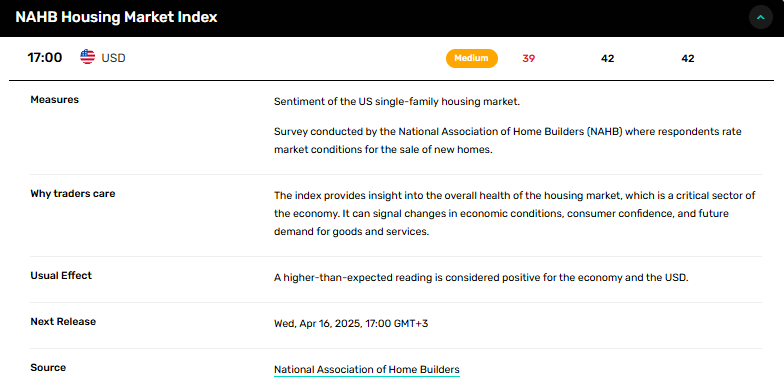

In a recent development, the National Association of Home Builders (NAHB) released its Housing Market Index for March 2025, highlighting a significant decline from 42 to 39. This decrease comes against the backdrop of a market expecting the index to remain stable. Let’s delve into the key figures and market reactions in detail.

Key Points

- The NAHB Housing Market Index for March was 39, down from February's 42, missing consensus expectations.

- Current sales conditions also dropped from 46 to 43.

- Sales expectations for the next six months, however, remained stable at 47.

Deep Dive: Market Impacts

Upon release of the disappointing housing market numbers, several market indicators responded:

Sales Trends: While 29% of builders reported price cuts in March (up from February’s 26%), average reductions remained steady at 5%.

The U.S. Dollar Index settled near session lows, reflecting the weaker-than-anticipated housing report. Consequently, gold prices rallied, surpassing the $2990 mark and aiming to break the $3000 barrier. The weakening dollar offered the needed impetus for gold markets.

Equity Market Response

The SP500 attempted to recover, testing session highs and showing positive momentum as traders speculated on a possible rebound following earlier declines.

Opinion & Analysis

This latest index drop suggests ongoing challenges in the housing sector, with notable impacts on builder sentiment and pricing strategies. Though the economic picture remains clouded, potential rebounds in equity markets could provide a counterbalance to these concerns.

For additional insights into current market trends and economic indicators, feel free to explore our economic calendar and other related articles.